Celebrating Our Journey to Becoming Xero Platinum Partners: How Your Trusted Business Advisors & Accountants in Haverhill Made it to the Top

We’re incredibly excited to announce a milestone moment for our team here at 1 Accounts Online. After years of hard work, dedication, and a commitment to excellence, we have officially become Xero Platinum Partners. This achievement places us among an elite group of UK accountants recognised for their expertise and service quality.

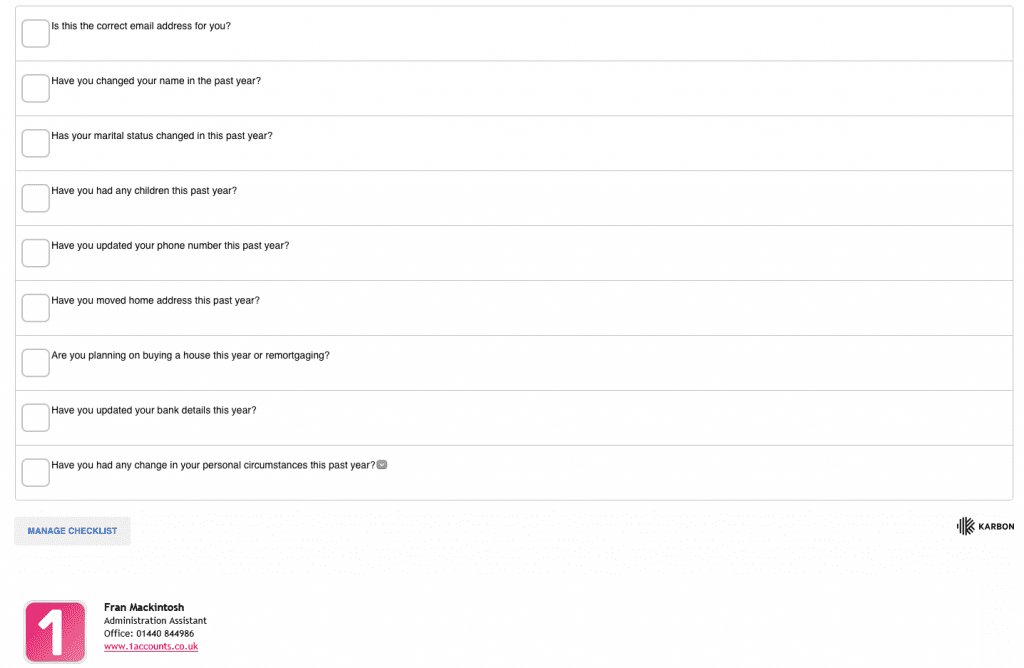

This journey began with a vision to be more than just accountants in Haverhill. We wanted to become trusted business advisors and coaches, helping businesses transform their financial management and achieve their objectives. Xero, with its innovative approach to online accounting, aligned perfectly with this vision, and we embraced its platform to provide a seamless, intuitive accounting experience to our clients.

Becoming a Xero Platinum Partner represents a commitment to efficiency, modernity, and exceptional client service. As UK accountants, we’re proud to be part of an community of accountants that Xero recognises for their dedication to clients.

At 1 Accounts Online, we’re not just accountants in Haverhill; we’re also renowned business advisors and coaches. We understand the challenges of running a business. That’s why our role as business coaches in Haverhill extends beyond numbers. We strive to provide strategies that help businesses thrive, with an emphasis on financial health, growth and sustainability.

This new status as a Xero Platinum Partner confirms our ability to provide superior service to businesses in Haverhill and beyond. It’s a validation of our skills and a testament to the relationships we’ve built with our clients, who trust us to guide their financial journey.

However, this achievement isn’t just about us; it’s about you – our clients. Your faith and trust in our services as your preferred UK accountants and business advisors have made this journey possible. We thank you for your unwavering support and promise to continue delivering excellence, innovation, and professional guidance.

So, whether you need expert accountants in Haverhill or dedicated business coaches in Haverhill, remember that at 1 Accounts Online, we’re committed to helping you build your dreams. This journey from zero to Xero Platinum Partner has been an exciting one. We look forward to continuing to strive for excellence together.

Thank you for being a part of our journey. Stay tuned for more exciting updates and insights from your trusted business advisors at 1 Accounts Online.