What Is A Payment On Account? Understanding the UK Tax System

A common source of confusion in the world of taxes, especially for those new to self-employment in the UK, is the ‘Payment on Account‘ system. With this post, we aim to demystify this concept for you in simple and easy-to-understand terms.

What Is A Payment On Account?

A ‘Payment on Account‘ is a tax payment made twice a year by self-employed people in the UK to spread the cost of the year’s tax. It’s a method used by HM Revenue and Customs (HMRC) to collect Income Tax and Class 4 National Insurance Contributions if you’re self-employed.

Why Do We Have Payments On Account?

These payments are essentially a way for the tax system to keep up with our fast-paced, modern world. Instead of waiting for the end of the tax year to pay all your tax in one go, Payments on Account split the bill into two smaller, more manageable amounts. This system helps prevent taxpayers from falling into significant tax debt.

When Are Payments On Account Made?

Payments on Account are made twice a year – on 31st January and 31st July. The first payment includes any unpaid tax from the previous tax year. The second payment acts as a ‘payment on account’ towards your next tax bill.

How Are Payments On Account Calculated?

Each Payment on Account is calculated as 50% of your previous tax year’s Income Tax and Class 4 National Insurance bill. These payments include a projection of your next year’s earnings, so they assume that you will earn a similar amount to what you did in the previous year. If your income significantly changes from one year to another, you can request to reduce your Payments on Account.

What About The July 31st Payment On Account?

The second Payment on Account, due by 31st July, is exactly the same as the first one paid in January. The total of your two Payments on Account is then deducted from your final tax bill for the next tax year. If your Payments on Account total more than your final tax bill, HMRC will repay the difference.

A Real-World Example of Payment on Account

Let’s say you’re a self-employed graphic designer, and your tax bill for the 2022/23 tax year came to £10,000. This would be due on 31st January 2024. However, in addition to this, you would also have to make your first Payment on Account towards the 2023/24 tax year. This would be 50% of your last tax bill, so £5,000.

Therefore, on 31st January 2024, you would actually pay £15,000 in total (£10,000 for tax year 2022/23 and £5,000 as your first Payment on Account for tax year 2023/24).

The second Payment on Account for the 2023/24 tax year (another £5,000) would then be due by 31st July 2024.

When you complete your 2023/24 tax return, if you find out that your actual bill for that year is £11,000, you’ve already paid £10,000 through your Payments on Account. This means you only need to pay the additional £1,000 by 31st January 2025. But remember, on this same date, you’ll also need to make your first Payment on Account for the 2024/25 tax year, which would be £5,500 (50% of the £11,000 bill for the 2023/24 tax year).

This example demonstrates how the Payment on Account system works in a realistic scenario. It ensures that your tax payments are spread throughout the year, making it easier to manage your cash flow as a self-employed individual.

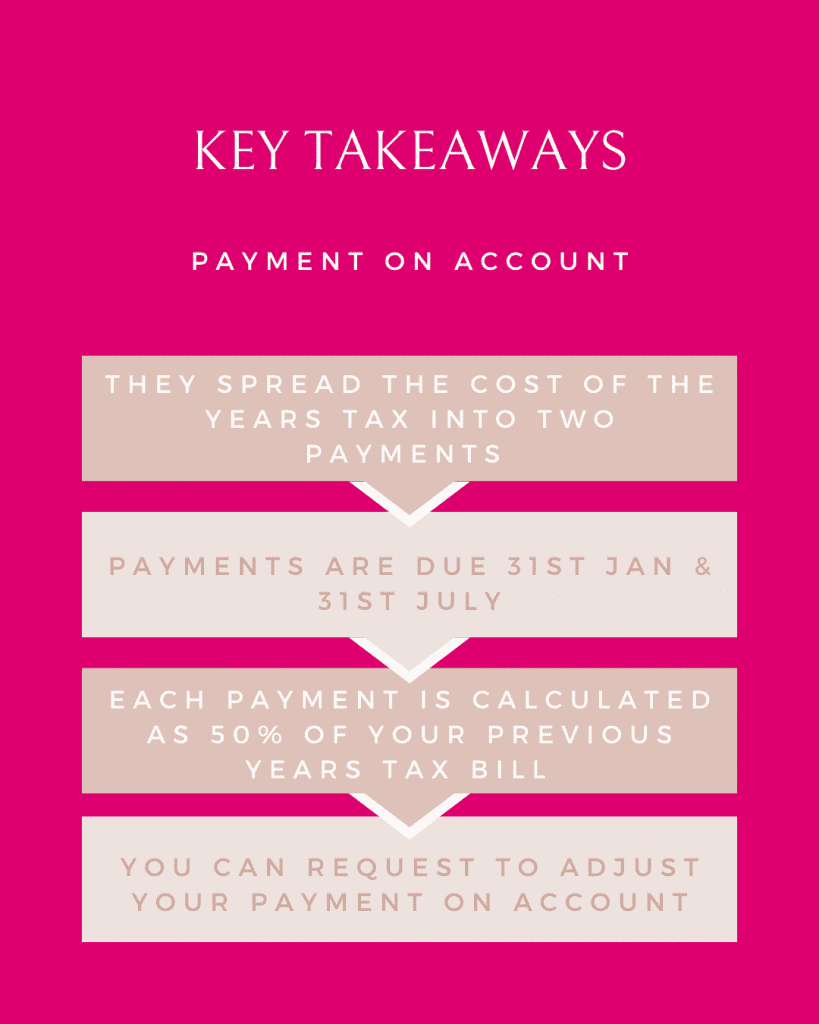

Key Takeaways

Navigating the UK tax system can be challenging, but understanding the Payment on Account system can make your tax life easier. Remember these key points:

- Payments on Account spread the cost of the year’s tax into two payments.

- Payments are due on 31st January and 31st July.

- Each payment is calculated as 50% of your previous year’s tax bill.

- If your income fluctuates significantly, you can request to adjust your Payments on Account.

In conclusion, a Payment on Account is a proactive method implemented by the UK tax system to ensure that self-employed individuals can manage their tax bills more effectively.

As always, if you’re uncertain about any aspect of your tax situation, it is highly advisable to consult with a tax professional. Happy tax planning!