Going Green = More Green Going green can help your business in more ways than one. Making changes can seem…

Going Green = More Green Going green can help your business in more ways than one. Making changes can seem…

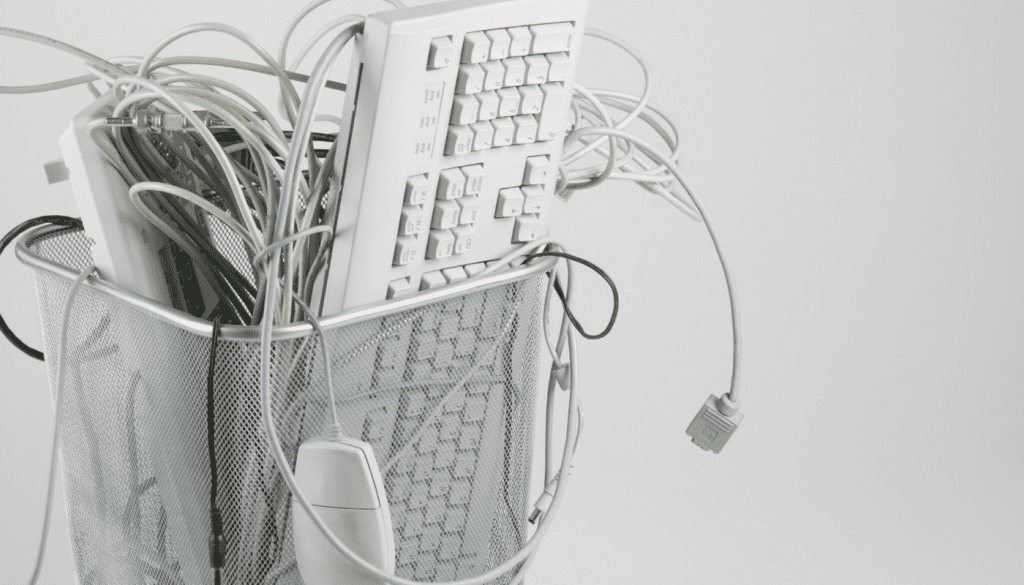

Recycle your WEEE Technology is a rapidly advancing sector, with new developments and devices being made all the time. This…

Giving Back to the Community As a business giving back to the community is important. The size of business or…

Capital Gains rules are changing! If you are a property investor or “accidental” landlord this is the blog for you….