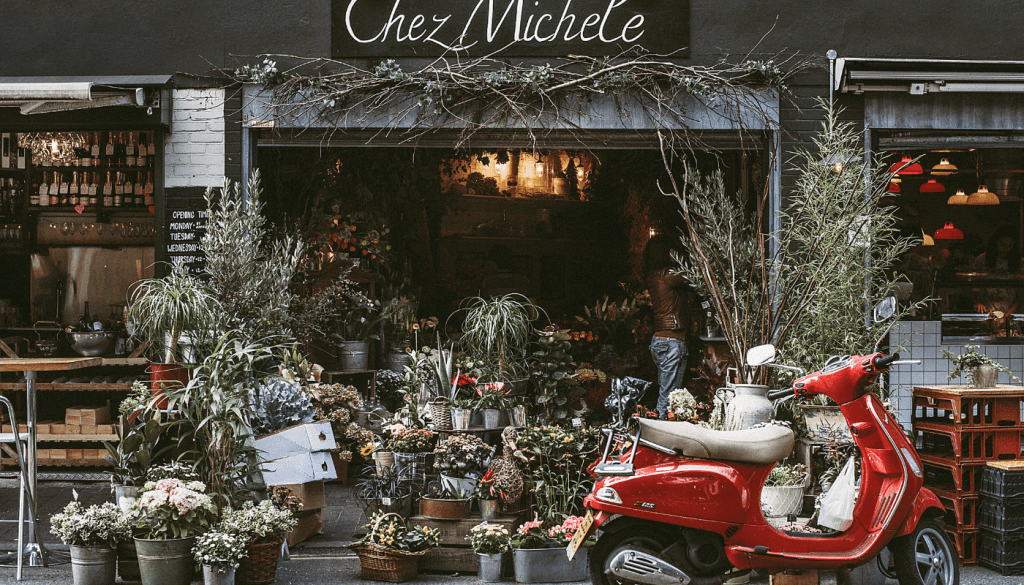

Supporting Local Independent Businesses 1 Accounts Haverhill is based on the top of the high street in Haverhill providing a…

Supporting Local Independent Businesses 1 Accounts Haverhill is based on the top of the high street in Haverhill providing a…

Is the Jaguar i-pace a good company car? Here at 1 Accounts in Haverhill and Cambridge we are often asked…

Making Tax Digital – Are You Ready? July 2019 marks the period that you have to submit your VAT returns…

Cloud Accounting Benefits If you want your business to work smarter and faster, cloud accounting software is a wise investment….