Tough Times Ahead – We Are All In This Together

Without doubt we are facing an unprecedented difficult time. Small business owners are trying to make money for themselves, their family and staff. It is looking likely that we will have to make some cutbacks and decisions that go against the grain.

As a small business we have a team to pay and clients to look after. We could just throw in the towel and say that we are all doomed; but we have sat back, feet on the table and reflected on the situation. We have looked at our own business, how we should respond and what new opportunities are available.

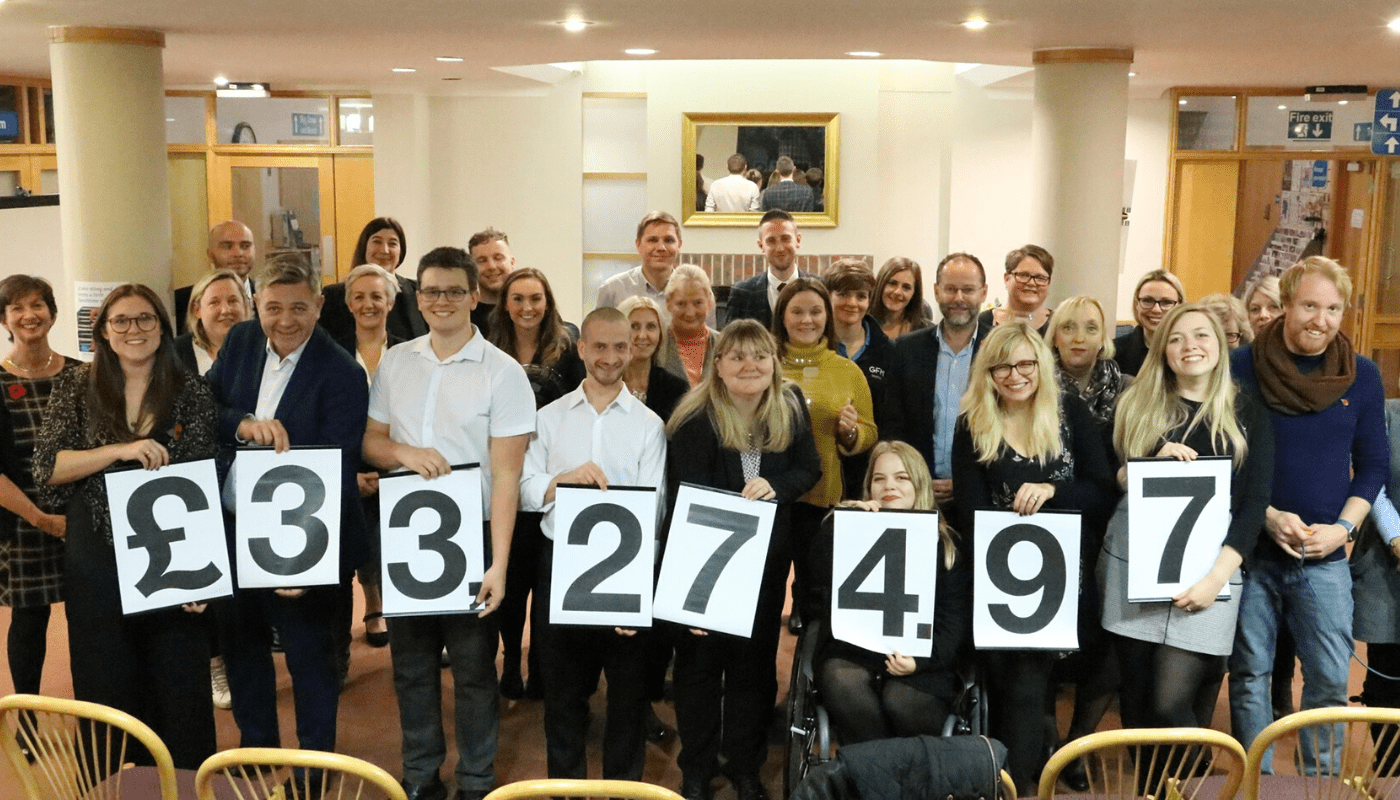

1 Accounts is a family run business with Paul, Jenni, Jade and Katie Donno all working in the office. They all depend on 1 Accounts as well as the fantastic team around them. We have very strong family values and we hope that this comes across to our clients in all that we do.

Unfortunately we will know someone that may well loose a loved one and we will be there to help them and support them in the best way we can. Pauls dad has been in poor health and the Donno family are continuously worried about him contracting the virus. We have found ways of supporting them with Paul’s mum phoning him nearly everyday with her food shopping order.

We are being told that 80% of the population will catch the virus. Experts have said that it is actually a mild flu and most people will recover. This means that at the end of this pandemic we will need to live again. The 1 Accounts team are looking forward to going back to the pub for a beer of three.

Here are our top tips for small business owners:

Be Positive

There is a lot of fake news out there and the media loves to sensationalise what Boris says. On March 16th Boris announced that where possible work from home. He used the phrase where possible as it is not possible for everyone. We would suggest you limit the news, especially Facebook (hard we know) so you can stay positive.

What do your customers need?

We have seen some great examples in and around Haverhill. Nine Jars are delivering coffee and paninis to the high street for £5, they are also offering food deliveries from their normal menu; for every 10th meal they deliver they will donate one to the local food bank. This is a great example of how to think ‘outside of the box’. Another local business Ben & Ella’s Farm Shop are offering an ‘Isolation Box’ that they can deliver. If customers can’t come to you – go to them.

Even Domino’s have a ‘no contact’ delivery service now – so even the big boys are adapting.

Small Wins

Look for the small wins and keep your overheads covered. When this finishes in a couple of months people will want to engage with you and will be craving human contact. You will need to plan, plan, plan to be able to survive the next couple of months. It is a good idea to watch China and see what they are doing, they are in front of us and will be showing the rest of the world what is next and how there economy is starting to bounce back. Also watch out and listen to people who have had the virus and how quickly they have recovered from it.

Communicate!

Tell your customers what you are doing and if you are suffering, tell them that too. Being open will help to gather the support you need. Also keep your team informed, this is a worrying time for them too. You need them as much as they need you.

Don’t cut back on your Marketing!

If anything increase your marketing and keep your message going. Tell your investors and suppliers what is happening and ask for help if needed.

If you are stuck on your social media speak to Jade and she will be happy to help you free of charge whilst the crisis is on. We want to help you in anyway we can to keep your business afloat. Afterall we need your business to keep going, to keep ours going.

Cash Is King

You will need more cash now more than ever before. Securing your cash is paramount. The government has announced that it will help small businesses with Statutory Sick Pay and government back lending; we will update you on this when we know more.

HMRC are extending their time to pay arrangements for PAYE, VAT and Corporation Tax to help you through this. We again can help you to organise this.

Check your business interruption insurance to see if you are covered and work with your broker to see how you can claim.

Look at your personal position and see if you can cut costs. Sky sports are not showing the Football or Rugby, now is the time to discuss this and get a reduction. Do you need the cinema and Gym membership if you can’t go?

We can help you and have changed our business model to treat your immediate needs above our normal day to day work.

We are all in this together.

Think Outside Of The Box

Your business will change by the end of this and hopefully for the better. We have lots of ideas and would be happy to brainstorm with you free of charge to help you get through this difficult period.

Be Kind

Above all, help your fellow small business and they will help you now and in the future. Do not take this opportunity to sell hand gel or toilet rolls at an inflated price, you will possibly have a more comfortable time now but you will not survive when business returns to normality. Paul still avoids a garage that inflated costs during the fuel crisis. Harming your reputation could be detrimental in the future.

Please give us a call – even if it is just to vent and we will be more than happy to help.

We are all in this together