Accountancy Services

for Limited Companies

Maximise the potential of your business

with our top-notch limited company services.

Increase the success of your business by tapping into the knowledge of experienced online accountants who are skilled in the complexities of running a limited company

From entrepreneurs starting up to established directors scaling their enterprise, our packages give you access to high-level financial advice. Unlock the potential of your business and watch it flourish with our tailored plans.

At 1 Accounts Online ltd, we have all the right resources and support to help businesses of any size thrive. Our packages provide high-quality financial advice, professional accounting services and robust business reporting, to make sure that every business grows to reach its full potential.

With us on your side, you'll have the tools to stay one step ahead. Take the pressure off, reduce workloads and monitor your company performance with precision. With comprehensive financial planning and comprehensive data-driven reporting, we help you create meaningful insights to shape the future of your business.

Find out how you can join our mission for limited company success. Whether you're at the start of your journey or accelerating the growth of an established business, contact us today to learn more about our 'Compliance Only, 'growing business' and 'the works' packages. Take the first step to achieving your ambitions - you won't look back.

View Our Accountancy Services

The Works

With monthly check-ins, one-on-one sessions, and thorough evaluations, our seasoned team of financial and business experts will illuminate your business' path and monitor its financial well-being.

Navigating your business' next steps won't be a guessing game anymore. Our service provides you with the tools and knowledge to make confident decisions, leading your business to flourish in its field. We alleviate the financial worry and risk associated with growth, placing the prospect of success directly within your grasp.

Let's transform your business together, taking it from good to great with The Works.

Growing Business

With our popular Growing Business service, we provide comprehensive and tailored support to get you on the path to success. Our team of experts provide comprehensive quarterly reviews and individualised solutions for you and your business. We also provide two director personal tax returns and dividend vouchers.

With Growing Business, you get unlimited access to our team for additional help and advice, giving you the edge over your competitors. Growing Business is the perfect solution to help you and your business thrive!

Compliance Only

We make starting and running your new business easier and less stressful, so you can get right down to work and achieve success!

With our Compliance Only service, you'll have peace of mind that you won't be hit with a large tax bill because of errors or non-compliance. Our service also helps you avoid problems down the line by taking all the guesswork out of setting up your business. No matter what kind of business you're starting, Compliance Only is here to help.

Get in touch with us today to see how we can help make starting and running your business stress-free and worry-free.

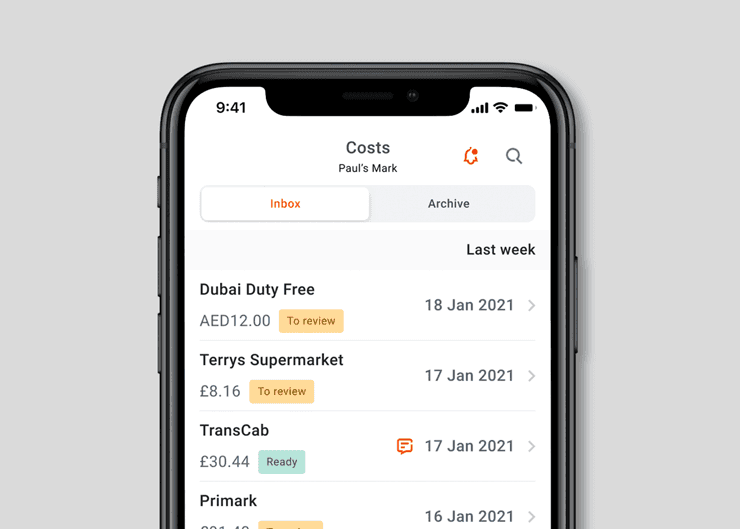

At 1 Accounts Online Ltd we understand how daunting managing finances can be. We believe that all businesses should have access to cutting-edge financial technologies to streamline processes, cut costs, and help you get more out of your business.

That’s why we have partnered with market-leading accounting software companies such as Xero and DEXT, providing on-going support and guidance. Through our tailored training packages, we can ensure that all members of your finance team have the skills they need to make the most of the software’s capabilities.

Not only can we provide guidance with the use of the software, we can also offer strategic advice and support to help your business grow and prosper. So, let us help you create a financial strategy for the future – contact us today to find out how.

Check Out Our Latest Blog

The Spring Budget – The Detail

On March 6, 2024, Chancellor Jeremy Hunt delivered a spring budget aimed at boosting public morale and securing voter support, especially important as an election looms and the UK faces economic challenges. This budget focuses on easing financial strains by lowering National Insurance for everyone, tweaking VAT rules for small businesses, and adjusting child benefit […]