Going Green = More Green Going green can help your business in more ways than one. Making changes can seem…

Going Green = More Green Going green can help your business in more ways than one. Making changes can seem…

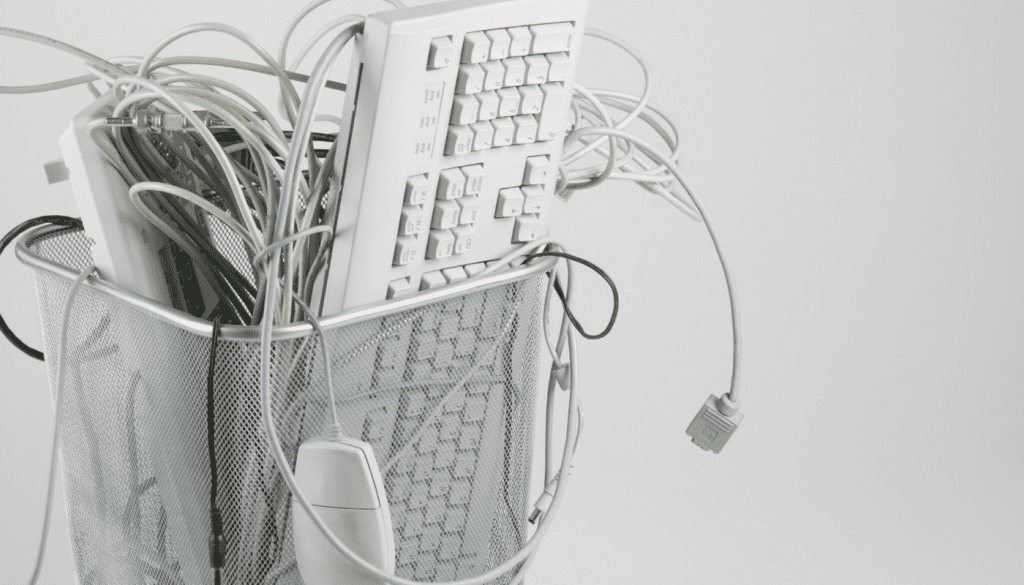

Recycle your WEEE Technology is a rapidly advancing sector, with new developments and devices being made all the time. This…

How to make your business more eco-Friendly. Since the industrial revolution both carbon levels and global temperatures have increased dramatically….

Is the Jaguar i-pace a good company car? Here at 1 Accounts in Haverhill and Cambridge we are often asked…

GREEN IS THE NEW BLACK Trees. Water. Carbon emissions. Time. Money. The environmental impact of paper production in the financial…