Our new service for Sole Traders. We have all asked the question “will periodic lockdowns become the new norm?” – No one…

Our new service for Sole Traders. We have all asked the question “will periodic lockdowns become the new norm?” – No one…

We get by with a little help from our friends. This classic Beatles song has never rung more true. Right…

Tough Times Ahead – We Are All In This Together Without doubt we are facing an unprecedented difficult time. Small…

Giving Back to the Community As a business giving back to the community is important. The size of business or…

2019 2019 was another great year for 1 Accounts Online. We have streamlined our processes, brought in more team members…

No one wants a Tax Investigation. It is true that as business owners we don’t want HMRC asking awkward questions…

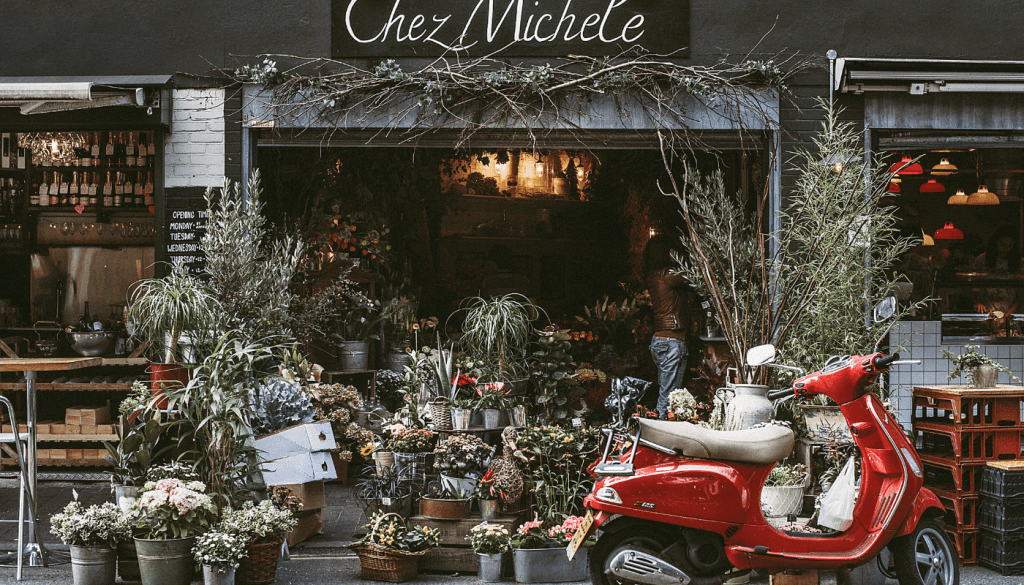

Supporting Local Independent Businesses 1 Accounts Haverhill is based on the top of the high street in Haverhill providing a…

Wine & Cheese Night In aid of the St Nicholas Hospice Accumulator Challenge 1 Accounts Online will be holding a…

MAY UPDATE May disappeared before our eyes, with tax returns, accounts and quarterly reviews in full swing. The sunshine has…

April Update With the start of a new tax year, lots of bank holidays and new starters 1 Accounts have…