Don’t let the Christmas period get in the way of the self-assessment deadline! Christmas is always a busy time of…

Don’t let the Christmas period get in the way of the self-assessment deadline! Christmas is always a busy time of…

No one wants a Tax Investigation. It is true that as business owners we don’t want HMRC asking awkward questions…

INSTANT RESPONSE TIME Growth in technology has lead to the need for instant gratification. With everything available at the click…

The Ultimate Guide to the Different Types of Business Financing Small business loans are being approved at an unusually high…

Are you thinking of getting a mortgage? This year we have had an abundance of clients applying for mortgages. Applying…

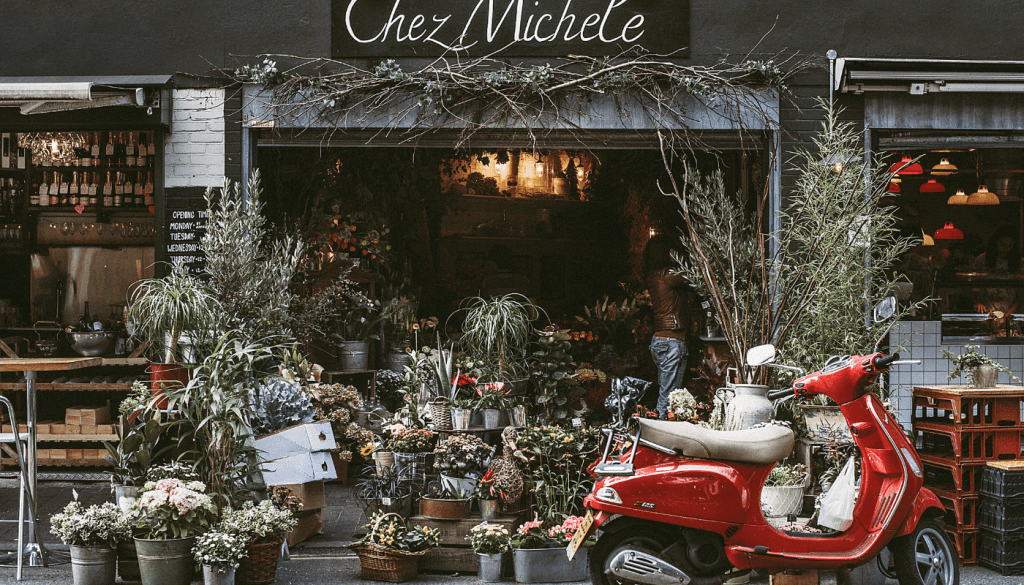

Supporting Local Independent Businesses 1 Accounts Haverhill is based on the top of the high street in Haverhill providing a…

Is the Jaguar i-pace a good company car? Here at 1 Accounts in Haverhill and Cambridge we are often asked…

Making Tax Digital – Are You Ready? July 2019 marks the period that you have to submit your VAT returns…

Cloud Accounting Benefits If you want your business to work smarter and faster, cloud accounting software is a wise investment….

Wine & Cheese Night In aid of the St Nicholas Hospice Accumulator Challenge 1 Accounts Online will be holding a…