It’s looking like remote working will be the ‘new normal’ as we ease our way out of lockdown. While this…

It’s looking like remote working will be the ‘new normal’ as we ease our way out of lockdown. While this…

With the recent easing of lockdown restrictions, several businesses are asking some of their employees to return to the workplace…

How to stay positive for your family and your team (even if you are scared and worried too) Do you…

Are your team actually working? With the phased reopening of businesses over the new few weeks to months, many businesses…

Flexible Furloughing From 1 July 2020, Businesses will have the flexibility to bring previously furloughed employees back to work part-time…

Sole Traders to get second grant from the Government. The government’s Self-Employment Income Support Scheme will be extended, giving more…

The portal opens this week to claim your grant is you are self-employed. This is capped as a taxable lump…

The government’s Coronavirus Job Retention Scheme will remain open until the end of October, The key points announced by Chancellor…

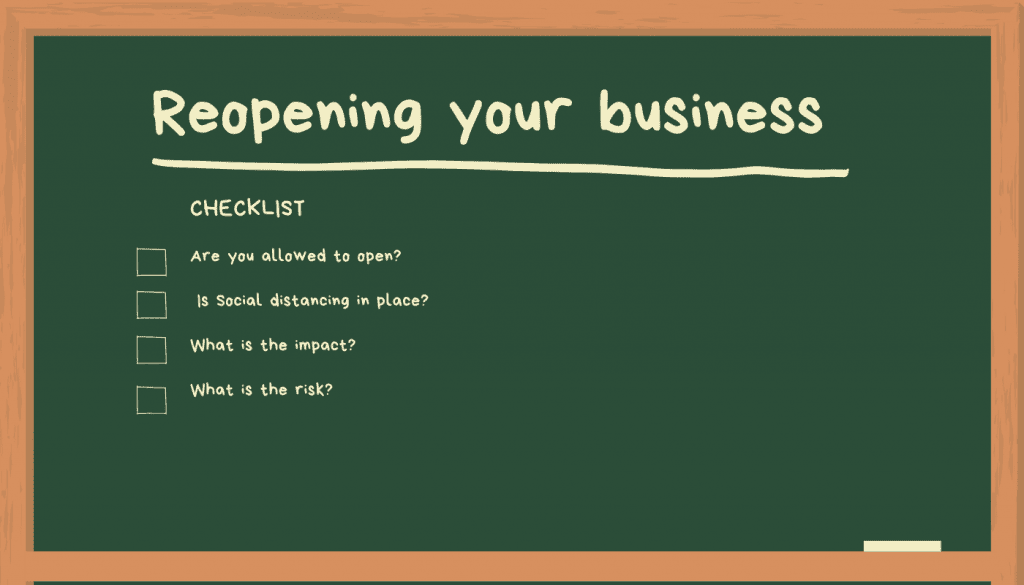

After Boris’ speech on Sunday, selected businesses are now allowed to open under the new HSE guidelines. If you are considering opening…

On Sunday Boris Johnson addressed the UK and gave a speech that confused the nation. Stay alert, control the virus,…