Your self-assessment tax return is the document that is needed to calculate how much tax you owe personally. This return includes your dividends, employment income, rental income etc. One way to ‘stress out’ your accountant is to send them your tax return information in January. However, many people don’t understand why January is so stressful for accounting firms. Therefore we wanted to explain why sending in your information before January is so important.

Important dates explained

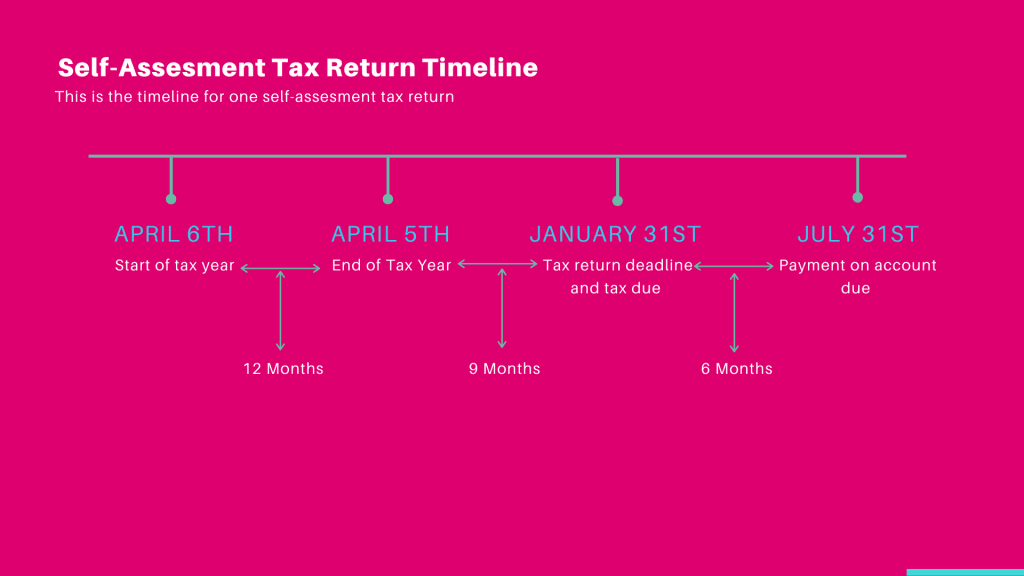

The tax year runs from April (of the prior year) to April (of the current year). For example, if we send you a request after April in 2020 for your self-assessment tax return information, it will be relating to information from April 2019 to April 2020. So the start and the end of the tax year.

The deadline to complete the return and pay any tax will be the following January, so in this case the 31st of January 2021. This gives you 9 months to get the return submitted and tax paid from the end of the tax year.

For anyone who has to pay a payment on account, this will be due the following July, so in this case the 31st of July 2021.

The way we work

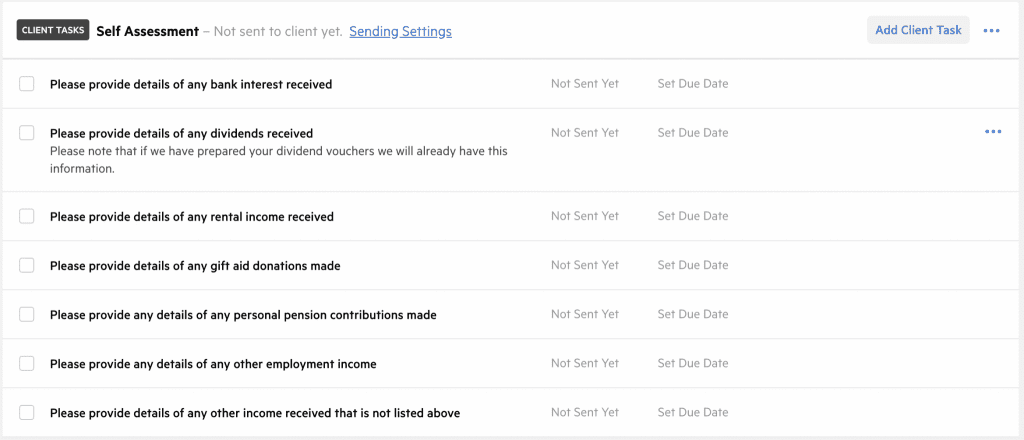

At 1 Accounts we use a system called Karbon to request self-assessment tax return information. At the end of the tax year on the 6th of April, we send out an automatic email requesting all the information we require to complete the return. We then send an automatic reminder email once a month for five months to those who haven’t uploaded the information. If you still haven’t sent in any information after this, you will get chaser emails from one of the team.

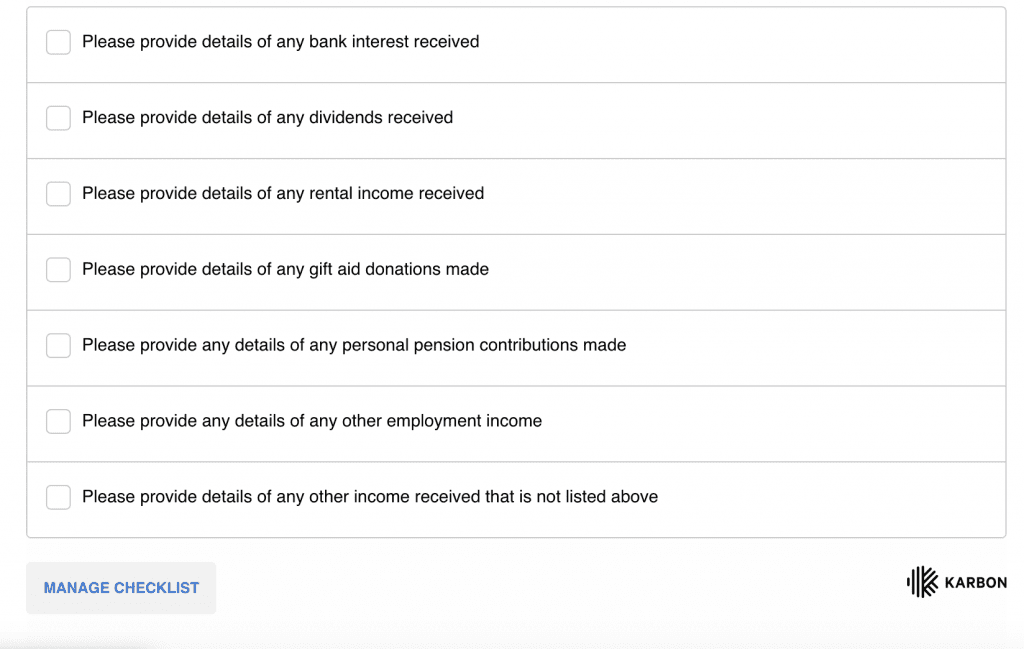

If you haven’t used our Karbon system before, it is nice and straight forward. All you have to do is click ‘manage checklist’ on the email.

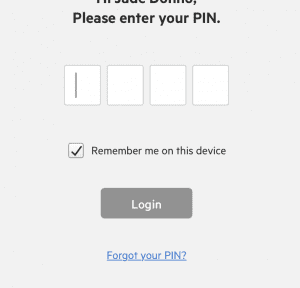

This will then direct you to create a pin number (make sure it is memorable). If you forget your pin, just click on the ‘forgotten your PIN?’ hyperlink and follow the steps.

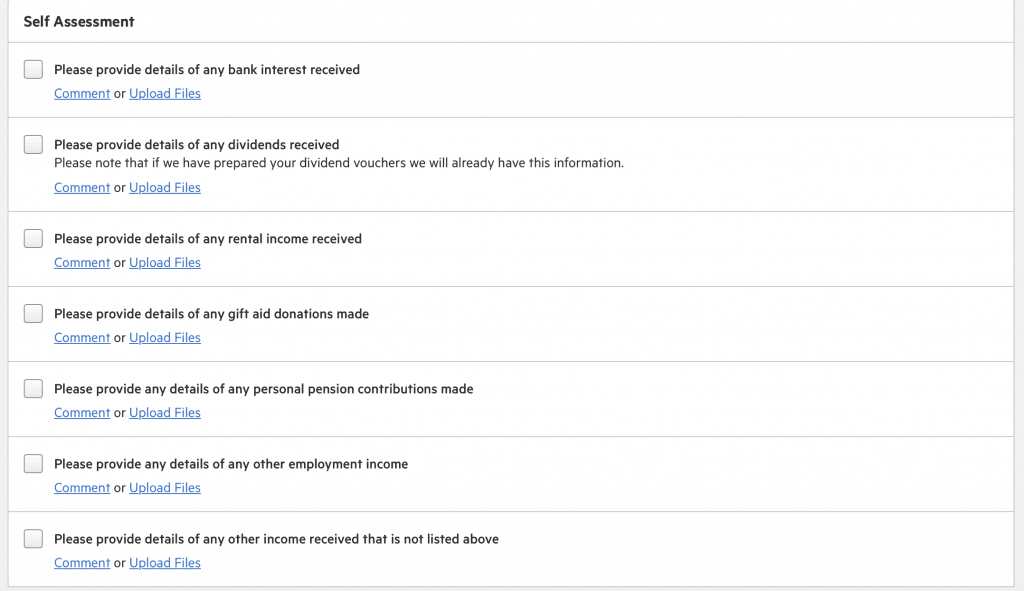

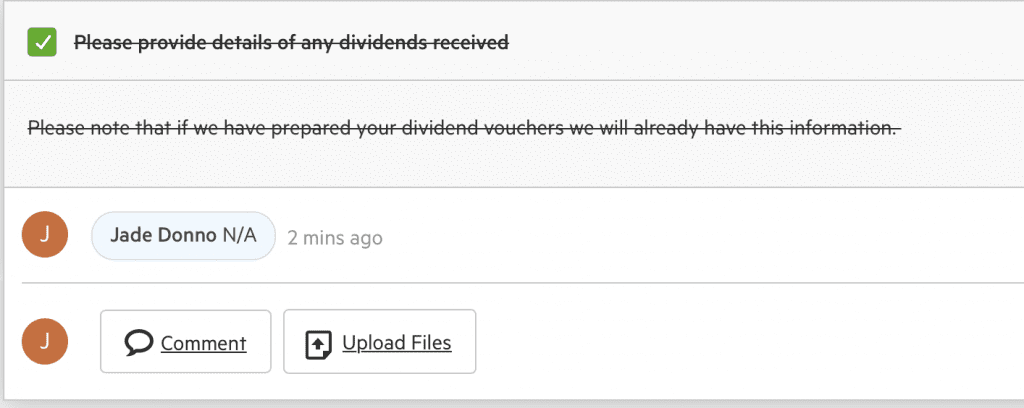

Once you are in, you will be able to see a checklist where you can comment and upload the information we have requested, or ask any questions. These comments come through to the team like an email.

Once you have completed a task we ask you to tick it off. The open tasks are what triggers the automatic reminders and so ticking them off will stop them.

If none of the information requests apply to you, we still need you to write N/A in the comments so we know it doesn’t apply.

Once you have completed your checklist and ticked off the tasks, please just log out or close the window. Your progress will be saved and we will be notified

For anyone sending us information after the 15th of December, there is no guarantee we will be able to complete the return on time.

So why Is January so stressful for accountants?

With January being the deadline for self-assessment tax returns, naturally many people leave it until the last minute. If you are completing your own return, then that’s fine, however waiting until January to give the information to your accountant will not make you very popular. No matter how much accounting firms prepare, January is always horrible. Not only are the Christmas festivities over, last minute tax returns are a given. If you have left your tax return until the last minute, bear in mind, that you are not the only one.

We advise you to send in your information any time between April to August. This will give us ample time to complete your return. The sooner you send us the information the sooner we can complete the return. We prioritise our returns on whoever sends us the information first.

On a side note, if you are looking to buy a house, your returns will need to be completed for your mortgage. If this is the case you will need to send us your information ASAP and let us know well in advance.

Remember your tax is due in January?

Your tax is due in January. This means that if you leave sending your information until the last minute you could end up with a large unexpected tax bill to pay straight away. If you return gets completed early, you will be able to prepare for paying any tax in January. Or for those lucky people, get a refund early.

Overall, accountants all over Britain ask nicely that you send your tax return information between the months of April-August so we can give you the best possible service and eliminate stressful Januarys once and for all.

If you have any questions on your self-assessment tax return please email jade@1accounts.co.uk