The portal opens this week to claim your grant is you are self-employed. This is capped as a taxable lump…

The portal opens this week to claim your grant is you are self-employed. This is capped as a taxable lump…

The government’s Coronavirus Job Retention Scheme will remain open until the end of October, The key points announced by Chancellor…

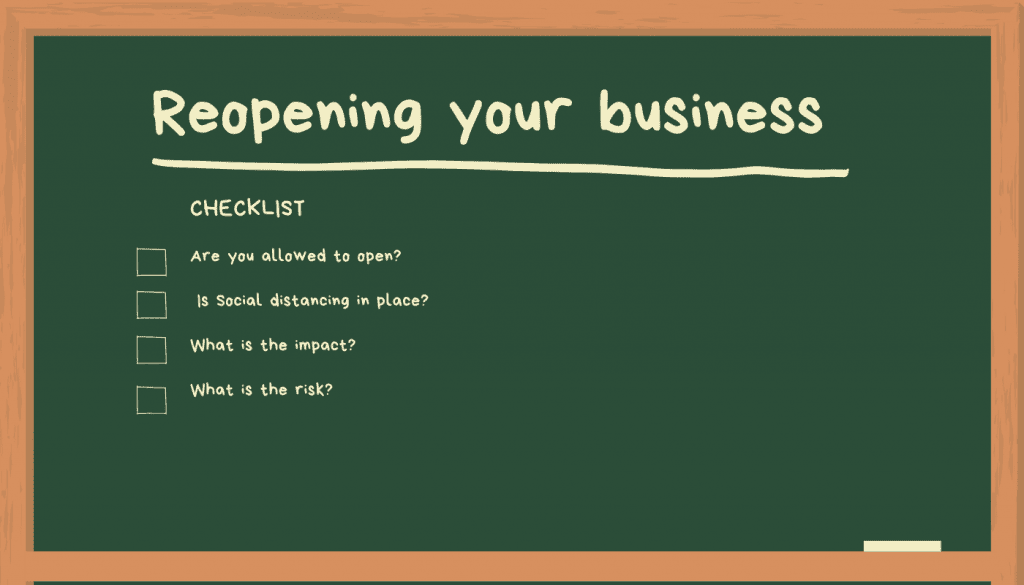

After Boris’ speech on Sunday, selected businesses are now allowed to open under the new HSE guidelines. If you are considering opening…

On Sunday Boris Johnson addressed the UK and gave a speech that confused the nation. Stay alert, control the virus,…

The help and advice that is available from the Government is forever changing. This is the latest update we have…

1 Accounts is a family run business with the Donno family all depending on the businesses survival. When lockdown was…